Common Bookkeeping Mistakes to Avoid: A Roadmap to Financial Accuracy

Accurate bookkeeping is the foundation of sound financial management for businesses of all sizes. Properly maintained financial records not only ensure compliance with tax regulations but also provide valuable insights into your company's financial health. Unfortunately, there are a number of bookkeeping mistakes that are commonly made that often lead to financial discrepancies, compliance issues, and missed opportunities. In this blog post, we'll explore some of the most common bookkeeping mistakes and provide you with a roadmap to financial accuracy.

The Art of Expense Tracking: Tips for Efficient Bookkeeping

Effective expense tracking is a fundamental aspect of sound bookkeeping and financial management for any business, large or small. It not only ensures that you have an accurate picture of your financial health but also helps you make informed decisions. In this blog post, we'll delve into the art of expense tracking and provide you with practical tips to streamline this critical aspect of financial management for your business.

Choosing the Right Bookkeeping Software for Your Small Business

Effective bookkeeping is the cornerstone of financial management for any small business. With the help of modern bookkeeping software, small business owners can streamline financial tasks, improve accuracy, and gain valuable insights into their financial health. However, with a multitude of bookkeeping software options available, selecting the right one can be a daunting task. In this blog post, we will help guide you through the process of choosing the best bookkeeping software for your small business.

Pros and Cons of Outsourcing Payroll: Making the Right Choice for Your Business

Payroll management is a critical function for businesses of all sizes. It involves calculating and disbursing employee wages, ensuring compliance with tax regulations, and keeping accurate records. Many companies will need to decide whether they want to manage payroll in-house, or outsource it to a specialized provider. In this blog post, we'll explore the pros and cons of outsourcing payroll to help you make an informed choice for your business.

Understanding the Canadian Tax Filing Deadlines: A Comprehensive Guide

Tax season in Canada can be a stressful time for individuals and businesses alike. To alleviate some of that stress and ensure you meet your tax obligations without any setbacks, it's essential to have a clear understanding of the Canadian tax filing deadlines. In this comprehensive guide, we'll break down the various tax deadlines in Canada, explain their significance, and offer tips for staying organized and compliant.

New T4/T4A Reporting Requirements for Canadian Employers - Canada Dental Benefit

For employers in Canada, the 2023 tax year introduces new requirements for T4 and T4A reporting that directly impact the Canadian Dental Care Plan.

Key Tips for Entrepreneurs and Small Business Owners

If you've registered a corporation in Alberta or are considering doing so, it's essential to understand the ongoing compliance requirements. One crucial aspect of maintaining your corporation's status is the annual return. In this blog post, we'll unravel the mysteries surrounding Alberta's annual return requirement, why it's important, and how to fulfill it.

Outsourcing vs. In-House Bookkeeping

Managing your small business's financial records is a critical task that can significantly impact your company's success. When it comes to bookkeeping, you have two primary options: outsourcing the task to a professional bookkeeping service or handling it in-house with your own team. Each approach has its own set of advantages and disadvantages. In this blog post, we'll explore the pros and cons of both outsourcing and in-house bookkeeping to help you make an informed decision about which approach best suits your business.

Demystifying Alberta's Annual Return Requirement for Corporation Registration

If you've registered a corporation in Alberta or are considering doing so, it's essential to understand the ongoing compliance requirements. One crucial aspect of maintaining your corporation's status is the annual return. In this blog post, we'll unravel the mysteries surrounding Alberta's annual return requirement, why it's important, and how to fulfill it.

Personal Service Businesses

Personal Service Businesses (PSBs) are a distinct category of businesses in Canada with unique tax implications. They are defined by the Canada Revenue Agency (CRA) based on specific criteria that differentiate them from other types of businesses. In this blog post, we'll delve into the CRA's criteria for classifying a business as a personal service business and explore the tax implications that come with this classification.

Navigating Canada's Residential Property Flipping Rule: What You Need to Know

Personal Tax Time Tips & Tricks. Here we are in the final stretch of personal tax season and I am sharing my tips and tricks as well as why you should hire a CPA to prepare the tax return.

Our Services

WE OFFER: Reliable accounting advice & services for people who own businesses. We also offer personal tax services if you aren't a business owner!

Salary vs. Dividends

Should you be paying yourself a salary or dividends? The answer is... IT DEPENDS. Each business owner has different priorities, and both have advantages and disadvantages. Below are the advantages and disadvantages of both.

How to organize your bookkeeping for the corporation

Lets develop a system which handles your bookkeeping whether you are just starting out or you are trying to get back on track, here is the steps to get your on the right track.

The Art of Expense Tracking: Tips for Efficient Bookkeeping

Putting off the bookkeeping will start to pile up and become a unmanageable task. This can lead to late filings and expensive penalties from the Canada Revenue Agency. Let’s avoid those penalties and put those funds back into growing the business!

Stress free solutions for small businesses: Part 2 - FAQs

The truth is, good bookkeeping is powerful! Let us show you the difference. We try to make this process easy for you and work with you to come up with the best solution for your needs. Every business is unique, and your bookkeeping services should be too.

Stress free solutions for small businesses: Part 1 - The Process

The truth is, good bookkeeping is powerful! Let us show you the difference. We try to make this process easy for you and work with you to come up with the best solution for your needs. Every business is unique, and your bookkeeping services should be too.

How do you pay yourself from the corporation?

How do you pay yourself from the corporation? Did you know it could be a mix of both and it should be based on your business and goals.

Forth Quarter

Set yourself up for success in Q4. First, get the bookkeeping caught up and then make a plan how to distribute any additional profit in 2022 or 2023.

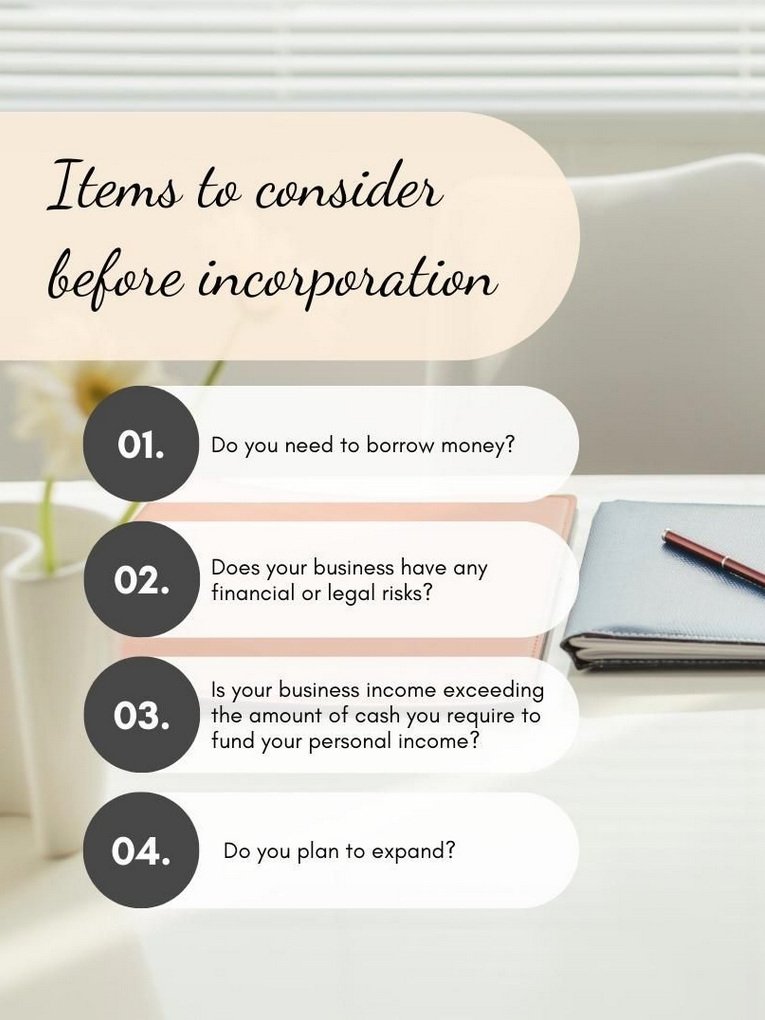

Items to consider before incorporation.

As a corporation, you can be separate from the business and therefore, determine how much income you wish to take from the corporation. You must declare all income that is taken from the entity for yourself personally, to record on a personal tax return. This is done by way of a T4/T5 filing requirement in February each year.